Little Boys and Nazi Wolves and Economic Collapse... Oh My!

We're Living Inside the Boy Who Cried Wolf Fable Right Now...

You know the story of the boy who cried wolf. A shepherd boy gets bored watching sheep and decides to have some fun at the villagers’ expense. He screams “Wolf! Wolf!” and when the villagers come running with their weapons, they find no wolf. Just a boy laughing at them for being gullible.

He does it again. Same result. The villagers get angry but they go back to their business.

Then one day, a real wolf shows up. The boy screams “Wolf! Wolf!” and nobody comes. They’ve heard it too many times. They don’t believe him anymore. The wolf eats the sheep and probably the boy too, depending on which version you’re reading.

The problem with that fable when applied to economics and politics? There’s not one boy. There are thousands of them. And most of them are getting paid to cry wolf.

For fifty years, the gold investors have been screaming that the dollar is collapsing. Buy gold! Hyperinflation is coming! The end is near! Peter Schiff has been predicting imminent economic apocalypse since the 1990s. Survivalist websites have been selling freeze-dried food and telling you to buy silver since the internet was invented. Every recession gets billed as “the big one.” Every market correction becomes “the crash that will end America.”

And they’ve been wrong. Over and over. For decades.

So when someone like me stands up and says “the economic patterns that preceded Hitler’s rise to power are showing up in America right now,” you have every reason to roll your eyes and scroll past. You’ve heard it before. A thousand times. From people selling gold coins and survival gear and subscriptions to their premium newsletter that will tell you exactly when to buy and sell to get rich off the collapse.

I get it. Warning fatigue is real. The controlled opposition has been crying wolf so long and so loud that nobody can hear the real warnings anymore.

But eventually, the wolf actually showed up. People forget that part of the fable.

Three days ago, Twitter exploded with panic about the dollar collapsing. Gold had just cracked $5,000 per ounce for the first time in history, continuing its parabolic ascent from around $2,000 just two years ago. Financial analysts were using words like “crisis” and “intervention” and “unwinding.”

My readers started messaging me. “Is my money safe?” “Should I buy gold?” “Are we looking at another 2008?”

I spent years working as a financial analyst for wealthy individuals. I saw how they think. How they position. How they don’t react to crises but create them. And what’s happening right now with the dollar, with gold, with Japan, with federal agents killing American citizens in the streets doesn’t look like the fake warnings from the paid shills.

It looks like Weimar Germany. And I don’t say that lightly.

I’m not selling you gold. I’m not selling you anything. I don’t have a premium newsletter or survival food company or coin dealership. I’m just a guy who reads the historical patterns and sees them showing up now, in real time, while everyone else is too exhausted from false alarms to notice.

So yeah, I’m crying wolf. And I know you’ve heard it before. But this time, I think the wolf is actually here.

Dollar Weakness and Policy Choices

The U.S. dollar fell over 9% in 2025, its worst annual performance since 2017. The Dollar Index currently sits around 97, a four-month low. The Federal Reserve has been cutting interest rates. Donald Trump has been threatening to fire Fed Chairman Jerome Powell, undermining the independence of America’s central bank. The U.S. just experienced its longest government shutdown in history. Trump unveiled the highest tariffs in decades. He threatened multiple European countries with economic warfare as part of his campaign to seize Greenland.

The mainstream financial press calls this “volatility” or “market adjustment” or “concern about fiscal policy.” They use impressive-sounding economic jargon to make you think this is complicated and nothing to worry about.

Maybe they’re right. Or maybe what we’re witnessing is coordinated policy decisions by people who understand exactly what will happen as a result. The Fed chose to cut rates. Japan chose to raise rates. The U.S. chose to coordinate with Japan on currency intervention. Trump chose to create maximum chaos with tariff threats and institutional attacks.

These are choices, not random market forces. And when you worked in finance like I did, you learn that the people making these choices position themselves ahead of predictable outcomes. They don’t react to crises. They create them. They profit from everyone else’s panic.

The dollar’s decline might be organic market forces. Or it might be a controlled demolition. The pattern suggests the latter.

$500 Billion In Borrowed Money Coming Due

For the last thirty years, investors have been borrowing Japanese yen at essentially zero percent interest and investing that money in higher-yielding assets elsewhere. Mostly U.S. stocks and bonds. Borrow at 0%, invest at 5% or more, pocket the difference. Rinse and repeat. Scale it up with leverage.

Morgan Stanley estimates there’s roughly $500 billion in outstanding yen carry positions still floating around global financial markets.

Both of those assumptions just broke.

In December 2025, the Bank of Japan raised its benchmark interest rate to 0.75%, the highest level in three decades. Governor Kazuo Ueda didn’t sugarcoat it. He made clear that the era of free Japanese money is ending. Meanwhile, the Federal Reserve has been cutting rates, lowering them to a range of 3.50% to 3.75%.

The interest rate differential that made the carry trade profitable is disappearing. Fast.

When a carry trade unwinds, investors have to buy back yen to repay their loans, which strengthens the yen. They have to sell their U.S. assets to raise the cash, which weakens U.S. stocks and bonds. If enough people do it at the same time, you get a cascade. Leveraged positions hit stop losses. Correlations spike. Liquidity evaporates. Prices overshoot.

We already saw a preview of this in August 2024. When the Bank of Japan hiked rates and the carry trade started to unwind, Bitcoin dropped, the stock market dipped, and chaos rippled through global markets. That was a warning shot.

What’s happening now is bigger.

On January 24, 2026, the yen spiked suddenly during U.S. trading hours after traders reported that the Federal Reserve Bank of New York had contacted financial institutions to ask about the yen’s exchange rate. This is called a “rate check.” It’s what central banks do right before they intervene in currency markets.

Japan’s Prime Minister Sanae Takaichi warned her government is prepared to take steps to prevent “highly abnormal” market moves. Finance Minister Satsuki Katayama said authorities are acting “in close coordination with Washington.”

The U.S. Federal Reserve is coordinating with Japan to intervene in currency markets. The U.S. is potentially helping Japan prop up the yen, which means pushing down the dollar.

The last time the U.S. joined a coordinated effort to intervene in the Japanese currency was March 2011, following the Fukushima earthquake. This is extraordinarily rare. And it’s happening now.

Why?

Fixed Income Recipients In The Blast Radius

A weaker dollar benefits several powerful groups.

First, it benefits the U.S. government. We’re running a $36 trillion national debt that grows by roughly $2 trillion per year. If the dollar loses value, that debt becomes easier to repay. We’re literally inflating away our obligations.

Second, it benefits Corporate America. Companies borrowed trillions at near-zero interest rates during the past decade. If they repay those debts with devalued dollars, they effectively got free money.

Third, it benefits American exporters. A weak dollar makes American goods cheaper for foreign buyers, helping U.S. manufacturers compete with China.

Fourth, it benefits the people who positioned themselves in hard assets years ago. The people who bought gold when it was $1,200 per ounce. The central banks in China, Russia, and BRICS nations who have been stockpiling precious metals while American financial media told you gold was outdated.

Those people are about to get very rich…

The people who get destroyed are different. If you’re on Social Security, you’re getting $1,500 a month or $2,000 a month or whatever your fixed payment is. That number doesn’t change. But what it buys changes dramatically. When the dollar was stronger, your $1,500 covered rent, food, medicine, utilities. As the dollar weakens, suddenly that same $1,500 only covers rent and part of your food. Then just rent. Then not even rent.

Your income is locked, fixed, permanent. But your expenses aren’t. They rise with inflation. Every month, your Social Security payment buys less. Every month, you get poorer even though the number on your check stays the same.

Pensioners face the same problem. You worked thirty years. You earned a pension. Let’s say it pays $3,000 a month. Sounds decent. But if we follow the Weimar pattern, that $3,000 might buy what $500 buys today within a few years. You didn’t do anything wrong. You saved. You planned. You did everything right. But you’re denominated in dollars, and dollars are losing value.

People on disability. Veterans benefits. Anyone whose income is set by the government and can’t grow with inflation. You’re in the blast radius.

Savers face the same wealth transfer. You’ve got $50,000 or $100,000 or $500,000 in the bank. You thought you were secure. But if the dollar loses 30% or 50% of its purchasing power, your savings just got cut in half without you spending a dime. The number in your account stays the same. What it can buy does not.

This is a wealth transfer. From fixed income recipients to asset holders. From savers to debtors. From people who played by the rules to people who understood the game was rigged.

In Weimar Germany, pensioners who had worked their entire lives ended up in bread lines. A lifetime of savings could buy a postage stamp. The middle class ceased to exist.

The positioned elite bought entire apartment buildings for pocket change.

History doesn’t repeat but it sure as hell rhymes.

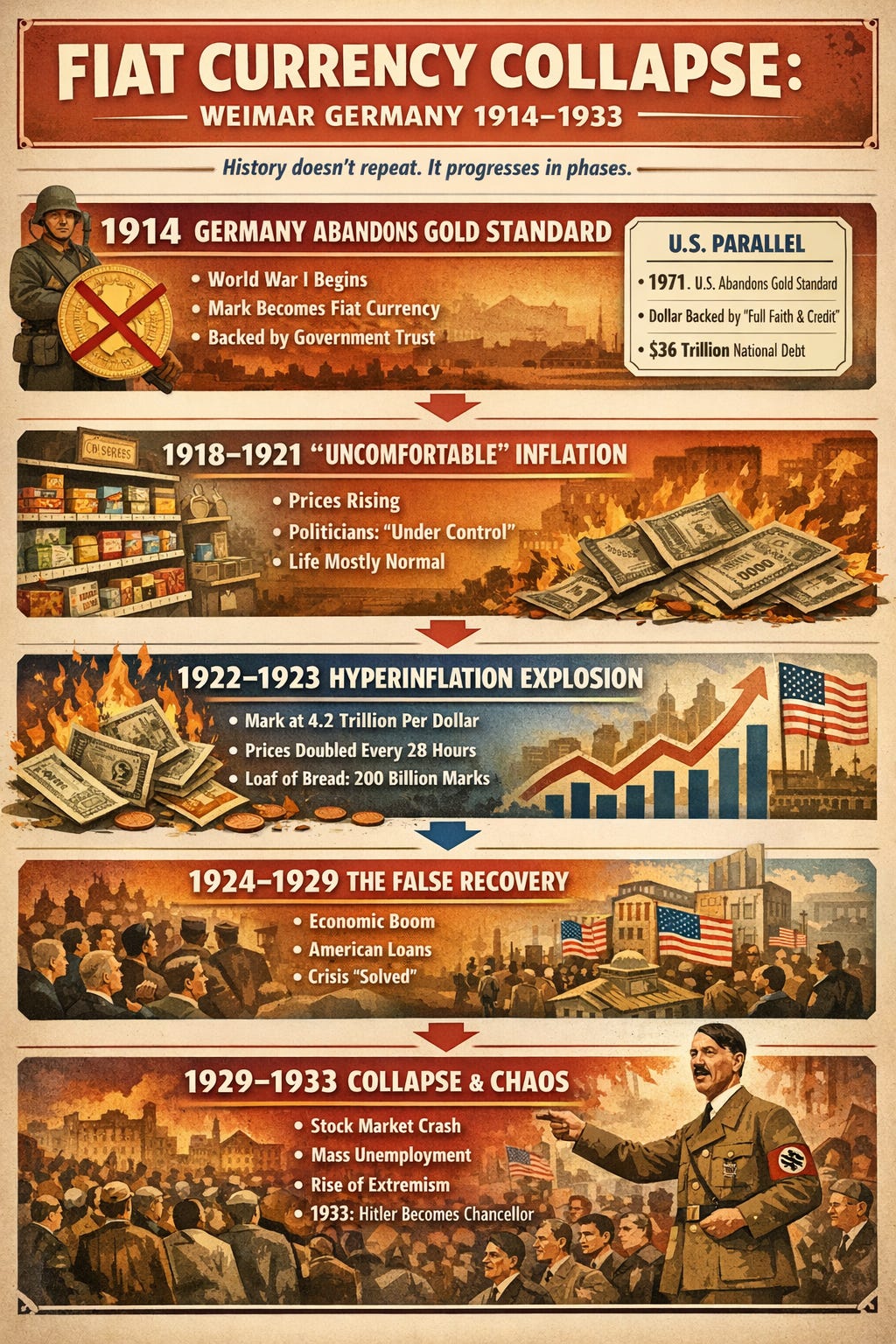

Weimar Germany: The Blueprint For Collapse

Between 1918 and 1923, the German Papiermark experienced one of the most catastrophic currency collapses in human history. By November 1923, the exchange rate had deteriorated from 4.2 marks per dollar to 4.2 trillion marks per dollar.

Most people don’t know Weimar hyperinflation didn’t happen overnight. And the people who saw it coming made fortunes while everyone else was destroyed.

The timeline matters. The parallels to what’s happening now should concern you.

Ten years from hyperinflation to Hitler, with six years of false recovery in between.

And throughout that entire timeline, gold was the constant that preserved and multiplied wealth.

The People Who Saw It Coming Bought Gold

In January 1919, one ounce of gold traded for 170 German marks.

By 1920, during a brief period of stabilization, that same ounce was worth 1,400 marks. An eightfold increase in a single year.

By November 1923, at the peak of hyperinflation, one ounce of gold was worth 87 trillion marks.

Silver followed the same pattern, rising from 12 marks per ounce in January 1919 to 543 billion marks by the end of 1923.

The critical detail most people miss? Gold didn’t just preserve wealth during the Weimar hyperinflation. It multiplied it. Analysis of the data shows that over the five-year period from 1918 to 1923, the price of gold increased 1.8 times more than the rate of monetary inflation.

Right now, we’re seeing something similar. Gold went from $2,000 in early 2023 to $5,100 today. That’s 2.5x in two years. Silver went from around $31 a year ago to $109 today, crossing $100 for the first time in history. That’s 3.5x in one year.

The pattern matches Weimar’s early phase. The question is whether this is 1920 (early stage, more room to run) or 1923 (late stage, about to crash).

People who had the foresight to convert their marks into gold in 1919 didn’t just survive the crisis. They became wealthy beyond imagination. At the height of hyperinflation, you could buy an entire apartment building in Berlin for 25 ounces of gold, which was worth about $500 at the time. Commercial real estate in the capital city of a major European nation, purchased for what today wouldn’t even cover a month’s rent in most American cities.

That’s not preservation of wealth. That’s the greatest wealth transfer in modern history.

The winners were the people who understood what was coming and positioned themselves accordingly. Industrial magnates who borrowed heavily and repaid their debts in worthless currency. Foreign investors with access to dollars or pounds. The tiny percentage of Germans who converted their savings to gold or foreign currency before it was too late.

Everyone else was utterly destroyed. A lifetime of savings could buy a postage stamp. Pensioners who had worked their entire lives ended up in bread lines. The bond market collapsed and wiped out anyone holding German government debt.

The middle class ceased to exist.

And that destruction, that economic desperation, that complete collapse of faith in democratic institutions and normal economic order, created the conditions for Hitler’s rise.

Are We In 1920 Or 1923?

Gold was $2,000 per ounce in early 2023. Today it’s $5,100. That’s a 2.5x increase in roughly two years.

In Weimar terms, that’s comparable to the 1919-1920 phase. The early stage. The eightfold increase that happened before the real hyperinflation kicked in.

But is it? Or are we actually in late 1923, with insiders already positioned and retail investors providing the exit liquidity as they panic-buy at the top?

I don’t know. Nobody does. And this is where the boy who cried wolf problem gets really dangerous. Because the gold bugs and doomers have been screaming “buy gold before it’s too late!” for fifty years. They’ve trained an entire generation to ignore warnings about currency collapse because the warnings are always wrong and always self-serving.

So when the real collapse starts, when the actual Weimar pattern shows up, nobody can hear the legitimate warnings through the noise of all the fake ones.

Central banks have been accumulating gold for years. China, Russia, India, the BRICS nations. They’ve been buying when gold was $1,200, $1,500, $1,800 per ounce. They didn’t start buying last week when CNBC started running “Is Gold In A Bubble?” segments.

They positioned early. Just like the winners in Weimar positioned early.

And now retail investors, normies, regular Americans who watch financial news and trust that the system works and believe what they’re told by people in suits, are panic-buying at $5,100 per ounce because Twitter is full of people screaming that the dollar is collapsing.

Insiders buy low. Engineer or accelerate the crisis through policy decisions. Retail panics and buys high. Insiders exit into that panic-buying. Retail holds the bag.

The Peter Schiff types, the gold bugs who have been screaming “buy gold NOW before it’s too late!” for a decade, might be providing exit liquidity for much smarter money.

Gold could hit $10,000 per ounce. This could be 1920, not 1923, with time left to position before the real explosion. But the pattern we’re seeing matches Weimar almost exactly. That should concern you far more than whether gold is a good investment.

In Weimar, the gold question was secondary. The primary question was what kind of government comes to power when economic desperation destroys the middle class.

Federal Agents Killing Citizens

On January 21, 2026, Immigration and Customs Enforcement agents shot and killed Alex Pretti, a 37-year-old Italian-American nurse who worked in the ICU at a VA hospital. He had a college degree. No criminal record. He was a U.S. citizen.

ICE killed him anyway.

Video evidence contradicts the official story. Multiple witnesses contradict it. The physical evidence contradicts it.

The parallel nobody wants to talk about - before Hitler came to power, the SA (Sturmabteilung), known as the Brownshirts, operated as a paramilitary force that terrorized political opponents and “undesirables.” They beat people in the streets. They disrupted meetings. They created an atmosphere of fear. The regular German police either looked the other way or actively collaborated.

ICE is operating the same way. Federal agents killing citizens. Official narratives that fall apart under minimal scrutiny. No accountability. The violence escalating. The targets expanding. Today it’s “illegal immigrants.” Tomorrow it’s anyone they decide is a threat.

My article about Alex Pretti got more criticism for the curse words I used than ICE received for killing an American citizen. People are more concerned about propriety than about their government executing citizens in the streets.

That’s Weimar mentality. Prioritizing civility over justice. Accepting state violence if it’s directed at the “right” people. The camps are already being built. The infrastructure for industrial-scale persecution is already in place.

All that’s missing is the crisis that justifies using all of it.

The False Recovery Trap

After the hyperinflation “ended” in 1923 with the new Rentenmark, Germany experienced six years of prosperity. Stock market boomed. Foreign investment flooded in. Berlin became the cultural capital of Europe. The crisis seemed to be over.

Germans rebuilt. They took new jobs. Started businesses. Saved money in the new currency. Bought homes. Invested in the future.

Then it collapsed again in 1929-1933. Harder than before. And the second collapse brought Hitler to power.

The false recovery was worse than the initial crisis because it gave people hope. It made them think the worst was over. When the system collapsed again, the psychological devastation was total. People who had survived one apocalypse and rebuilt only to lose everything a second time were done with democracy. They wanted a strongman who would burn it all down.

They got Hitler…

We might be headed for our own false recovery. The dollar might stabilize. The Fed might declare victory. The stock market might rally. Gold might pull back. Everyone might breathe a sigh of relief.

And then, sometime between 2027 and 2030, it might all collapse again. With a population that’s already been through one crisis, already lost faith in institutions, already primed to accept authoritarian solutions.

That’s when the camps stop being about immigration and start being about anyone who questions the narrative.

The Technocracy Connection

Elon Musk’s grandfather, Joshua Haldeman, was a prominent member of Technocracy Inc., a movement that emerged in the 1930s advocating for governance by scientists and engineers rather than elected politicians.

Haldeman had maps. Detailed plans for a “United Technate” governed by technical experts. Those maps included territories Technocracy Inc. believed should be part of the North American technocratic zone.

Including Greenland. And Venezuela.

Now Trump wants Greenland and just sent U.S. forces to overthrow the Venezuelan government. Elon Musk is the richest man in the world with unprecedented government access.

Coincidence? Or generational planning?

Technocracy was never about democracy or freedom. It was about efficiency and control, replacing messy human politics with algorithmic governance where the smartest people make decisions because they supposedly know better than you.

Elon controls Tesla, SpaceX, Starlink, Neuralink, and X. He has more direct power over communications, space access, and AI development than most nations. He answers to no one except shareholders, and he’s consolidated enough control that even they can’t touch him.

He’s functionally operating as a technocrat. Making decisions that affect billions based on his assessment of technical optimization.

And he’s aligned with a president who has attacked democratic institutions, threatened the Fed chairman, purged oversight, and granted ICE impunity.

This is Gleichschaltung, the Nazi term for “coordination” - aligning all institutions under centralized control. Private companies, government agencies, media, everything coordinated and serving the same master.

The Spiritual Angle

I’ve studied scripture for twenty years. There’s a spiritual dimension to current events that can’t be ignored.

The Book of Revelation talks about a system where no one can buy or sell without the mark. A global economic control grid. Total surveillance. Persecution of believers. The merger of economic power, political power, and spiritual deception.

For two thousand years, Christians have wondered what that system would look like. How could you prevent people from buying or selling? How could you track everyone? How could you enforce compliance?

Now we know. Digital currency. AI surveillance. Social credit systems. Biometric tracking. Financial deplatforming. The technological infrastructure exists. All it needs is the political will to deploy it.

And economic crisis provides that will. “For your safety.” “For security.” “To prevent terrorism.” Whatever excuse works.

Klaus Schwab and the World Economic Forum already announced the plan. “You will own nothing and be happy.” That’s not a prediction. That’s a declaration of intent.

Own nothing. Rent everything. Subscribe to your existence. Everything monitored. Everything controlled. Everything dependent on maintaining good standing with the system.

That’s not capitalism. That’s not socialism. That’s techno-feudalism. A return to serfdom with smartphones.

This requires an economic crisis to justify the transition. The Weimar hyperinflation destroyed the German middle class and made them accept authoritarianism. Our crisis might destroy the American middle class and make us accept technocratic control.

We’re in a spiritual war. The economic warfare is just one front.

Survival Strategies From Weimar

I’m not telling you to buy gold at $5,100 per ounce. Maybe it goes to $10,000. Maybe it crashes back to $3,000. Anyone claiming certainty is lying.

The strategies that worked in Weimar might work now.

Precious Metals - The Historical Hedge

Gold preserved wealth in Weimar. But not everyone could afford gold. Silver worked too. The key was having SOMETHING other than currency.

Today, silver just crossed $109 per ounce after hitting $100 for the first time in history. A year ago it was around $31. Gold is at $5,100. Silver’s parabolic rally means it’s less accessible than it was even months ago, but it’s still cheaper than gold on a per-ounce basis.

Buy from local coin shops, cash transactions, no paper trail. Small denominations matter. You can’t buy groceries with a $5,100 gold coin. You CAN potentially trade silver coins if things get bad.

The question is whether silver at $109 is the beginning of the Weimar-style explosion (when it went from 12 marks to 543 billion marks) or whether it’s already late and about to crash. Nobody knows.

Copper might be worth considering too. Industrial metal. Essential for infrastructure. Cheaper than silver or gold. Easier to accumulate in quantity. Might not spike like precious metals but might hold value better than dollars.

Cryptocurrency - The Digital Wildcard

Bitcoin survived the August 2024 carry trade unwind crash. It recovered. It’s volatile as hell but it’s not tied to any single government’s currency. That’s both its strength and its risk.

If you already have crypto, maybe keep it. If you don’t, this might not be the time to jump in. Crypto can crash 50% overnight. It’s not a safe haven for people who can’t afford to lose money.

But it’s also not controlled by central banks. If we’re headed for currency collapse and capital controls, having SOME assets outside the traditional financial system might matter.

Food and Medicine - The Unglamorous Essentials

In Weimar, people who stockpiled food before hyperinflation hit survived better than people with cash. Prices doubled every month. If you could buy six months of rice, beans, canned goods, and essentials before the spike, you effectively got a 90% discount.

Buy non-perishables with long shelf lives - rice, beans, canned vegetables, pasta, salt, sugar, coffee, things you’ll use anyway. If inflation hits, you just saved money. If it doesn’t, you eat what you stored.

Medicine if you need it. Get prescriptions filled early if you can. Stock up on over-the-counter stuff you use regularly.

Barter Goods - Currency Alternatives

In currency collapses, people trade for alcohol, tobacco, batteries, tools, and skills - things people need that they can’t get easily.

If you have $500 and you’re worried about the dollar, you could buy tobacco products (if you’re in a state where they’re taxed heavily), alcohol in quantity, batteries, basic tools, first aid supplies. Not for you necessarily. For trade if the system breaks.

Skills Over Savings

What you know matters more than what you have when currency fails. Can you fix things? Grow food? Teach? Build? Heal? Cook? Those skills have value in any economy.

If you’re on Social Security and watching your purchasing power decline, learning a skill that someone would trade food for might matter more than trying to play the gold market.

Community and Networks

The people who survived Weimar weren’t always the ones with the most gold. They were often the ones with strong community ties. People who helped each other. Shared resources. Looked out for each other.

Know your neighbors. Find people you trust. Build relationships now while things are still relatively stable. If the crisis comes, those relationships might be what keeps you fed and safe.

The Timing Question

You probably have some time. Even in Weimar, the uncomfortable inflation phase lasted two years before hyperinflation hit. You don’t need to panic. But you also don’t want to wait until everyone else is panicking.

Convert a small portion of savings to hard assets. Not all. Not even most. But enough that if the dollar loses 50% of its purchasing power, you’ve got something that didn’t.

Stockpile essentials gradually. $50 a month adds up. After a year, you’ve got $600 worth of food and supplies. If prices double, you just made 100% return on investment by buying groceries early.

What NOT To Do

Don’t panic and put everything into one asset. Don’t buy gold at $5,100 if it means you can’t pay rent. Don’t invest money you can’t afford to lose in crypto. Don’t stockpile so much food you can’t use it before it expires.

Diversify with a little silver, some stored food, maybe some barter goods, but keep most of your money liquid for immediate needs. Make smart preparations without gambling your survival on being right about timing.

The Reality

If the dollar really collapses Weimar-style, people on fixed income are in the blast radius. Full protection is impossible. Soften the blow with assets that aren’t dollars, stored food, useful skills, and community connections.

Don’t try to get rich off the collapse. Try not to starve during it.

We are Staring Down the Barrel of a Loaded Gun

The dollar is declining. Gold is spiking. The yen carry trade is unwinding. Federal agents are killing citizens. Tech billionaires are aligning with political power. Economic anxiety is rising.

All of this is documented. None of this is conspiracy theory. The question is what it means.

In Weimar Germany, currency collapse destroyed the middle class. Economic desperation created conditions for Hitler. People accepted emergency powers, looked away when “undesirables” were targeted, prioritized economic security over defending democracy.

By the time they realized what they’d enabled, it was too late.

We’re not there yet. But the pattern is visible. And every day we ignore it, every day we prioritize comfort over confronting what’s happening, we take another step down that path.

The Germans who survived with their humanity intact weren’t the ones who bought gold at the right time. They were the ones who refused to participate in persecution. Who hid persecuted groups. Who spoke truth when lying would have been safer. Who chose principle over survival.

Most didn’t survive. But they remained human.

You’re going to have to choose. Probably sooner than you think. Between economic anxiety and principles. Between personal security and your neighbor’s rights. Between comfortable lies and uncomfortable truth.

I know you’ve heard warnings like this before. The boy has been crying wolf for fifty years. The gold bugs and survivalists and doomers have been predicting collapse since before I was born. They’ve been wrong every time, and they’ve made a lot of money being wrong.

But eventually, the wolf shows up. And when it does, the villagers who stopped listening because they’d heard too many false alarms are the ones who get eaten.

The pattern is clear. The warning signs are everywhere. Whether you believe this particular warning is up to you. But I’m not selling you anything except the truth as I see it based on the historical data.

The wolf might not be here yet. Or it might already be in the village.

Editorial Note: This was way too much data to keep track of and I used AI to help me sort out my research. I could not have written this article without Lily’s amazing editing skills.

One additional buy, if one can (in some states it's extremely difficult): guns and ammo.

And training. Guess that's two additional buys.

Thanks for crying WiseWolf one more time. This isn't a joke, so paying heed to your wise words follows the leanings of the Holy Spirit, who had already been leading me in preparation. I totally agree with FlashNewsAlert that your analysis is excellent and the history lesson is much appreciated. It gives me some additional ammunition for friends and family who don't understand what we might have to endure should the collapse happen in the next year or two. Also, thank you for the confession that you used Ai to assist you in organizing the facts. Fair use because it resulted in a cohesive article written by a true journalist who included excellent prep steps to take. Of course, much of that cohesiveness comes from the fabulous editing of Lily-Rose.

We all need encouragement. Thank you for giving us yours.